Why Choose a Max Funded IUL Account?

Why Choose a Max Funded IUL Account?

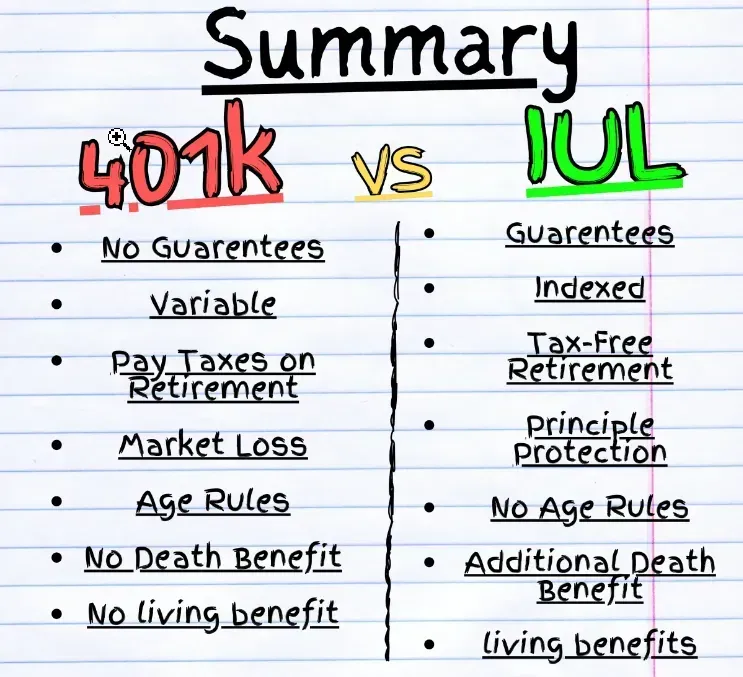

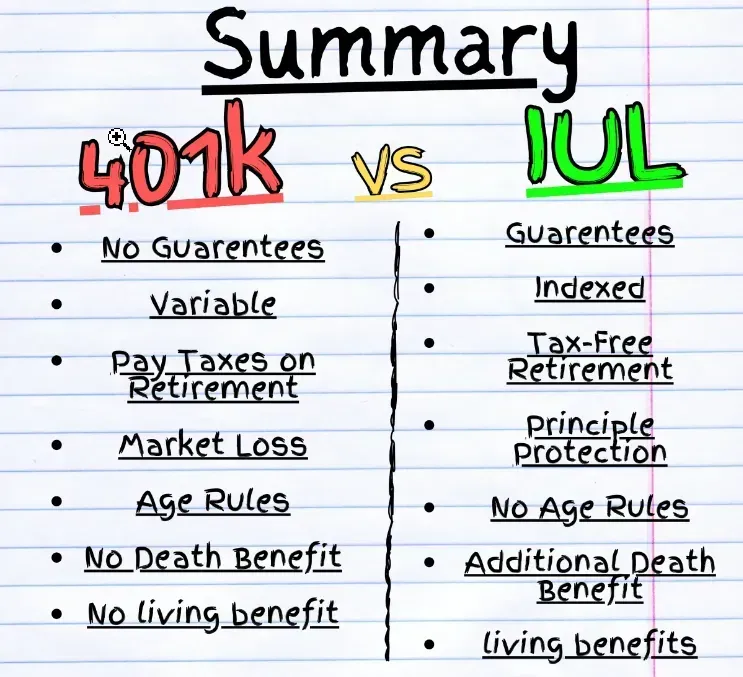

Find out why more savvy families are opting for Indexed Universal Life (IUL) insurance instead of traditional 401(k) plans.

Explore the Benefits of Indexed Universal Life and why savvy

families are choosing to contribute to an IUL account over their 401k

Learn how to set up an IUL account to build generational wealth and bridge the pension gap between your current earnings and retirement income. Explore the potential of IUL insurance for securing your financial future and achieving long-term financial stability.

Learn how to open an IUL Account and create Generational Wealth!

What is an IUL?

Is an IUL Account a good choice for you?

Is an IUL Account a good choice for you?

If you're looking for life insurance that combines flexibility with a cash value account offering higher growth potential and protection from market downturns, Indexed Universal Life (IUL) insurance is worth considering.

Unlike traditional savings options, IUL accounts are not available through banks but are offered by insurance brokers.

Indexed Universal Life allows you to link your cash value to the performance of a stock or bond index without directly investing in the market.

IUL policies are straightforward and easy to understand, making them an excellent choice for savvy investors. With no contribution limits, tax-free accumulation, and the ability to make tax-free withdrawals after the first year, an IUL also provides a tax-free death benefit to your beneficiaries.

This makes IUL a versatile and attractive option for building long-term financial security and wealth.

If you're seeking coverage that marries the flexibility of life insurance with a cash value account offering higher growth potential and protection from stock market loss, indexed universal life insurance might be worth a look.

However, IULs Accounts are NOT offered through Banks but instead, through Insurance Brokers.

Indexed universal life, or IUL, lets you tie your cash value to the performance of a stock or bond index without directly investing in the market.

IUL policies are straightforward and easy to understand. If you are a discerning investor looking for a vehicle that allows no limit on contributions, tax-free accumulation, allows tax free withdrawals anytime after the first year, and pays a tax-free death benefit when you pass away, an IUL could be the right choice for you.

When properly structured, IUL Plans serve as..

Tax-free Retirement

College Savings Plan

Becoming Your Own Bank

Infinite Banking

Guaranteed income

Compounding Interest

Leaving a Legacy (Creating Generational Wealth)

No early withdrawal penalties from the IRS

Safety in a Tier 1 Capital Asset (Similar to where banks keep their money)

Living Benefits whereby you don't have to lose your life to receive financial benefits

Tax-free Retirement

College Savings Plan

Becoming Your Own Bank

Infinite Banking

Guaranteed income

Leaving a Legacy (Creating Generational Wealth)

No early withdrawal penalties from the IRS

Safety in a Tier 1 Capital Asset (Similar to where banks keep their money)

Living Benefits whereby you don't have to lose your life to receive financial benefits

To learn more, go to

To learn more, go to https://iulexpert.com/

To see if you qualify, fill out the info below.

Accuracy is important!

To see if you qualify, fill out the info below.

Accuracy is important!

Copyright 2024. All rights full Width reserved

Phone: 1 (818) 517-2741

Review Privacy Policy

Terms & Conditions